alva is now Penta. We are the world’s first comprehensive stakeholder solutions firm. Learn More

Hit enter to search or ESC to close

Reputation has become an increasingly well-understood issue for boards and executives with regulatory pressure increasing to demonstrate the measures taken to understand and engage with stakeholders.

For this reason, more and more companies are aware of reputational risk and are wondering how to measure this reputation risk, that can affect their business.

In this context, the historic, somewhat informal approach to assessing reputation risk – namely asking internal stakeholders what they think – is no longer fit for purpose, if indeed it ever was.

Boards need more precise quantification of reputation risk, how it is evolving and the negative impact posed by certain issues, to support better decision making and the balancing of risk versus reward.

As the awareness and need for reputation risk management has increased, thankfully so too has the sophistication of the tools available to measure this historically nebulous and intangible asset.

The wealth of secondary research data from sources such as social media, as well as more traditional outlets such as print, online and broadcast channels, coupled with analyst notes and parliamentary records, allows companies to listen and understand the thoughts and feelings of their different stakeholders. This incredibly rich set of data paired with deep learning techniques such as neural networks enables the structuring of previously unstructured data.

This structure starts with the basic building blocks (Entities) to identify companies, products, or people, but can expand to organically surface topics – and by extension – risks for each of these Entities.

With weighted sentiment measures applied to this, companies can very quickly build a picture of the biggest risks they face as an organisation, prioritized by current impact and severity.

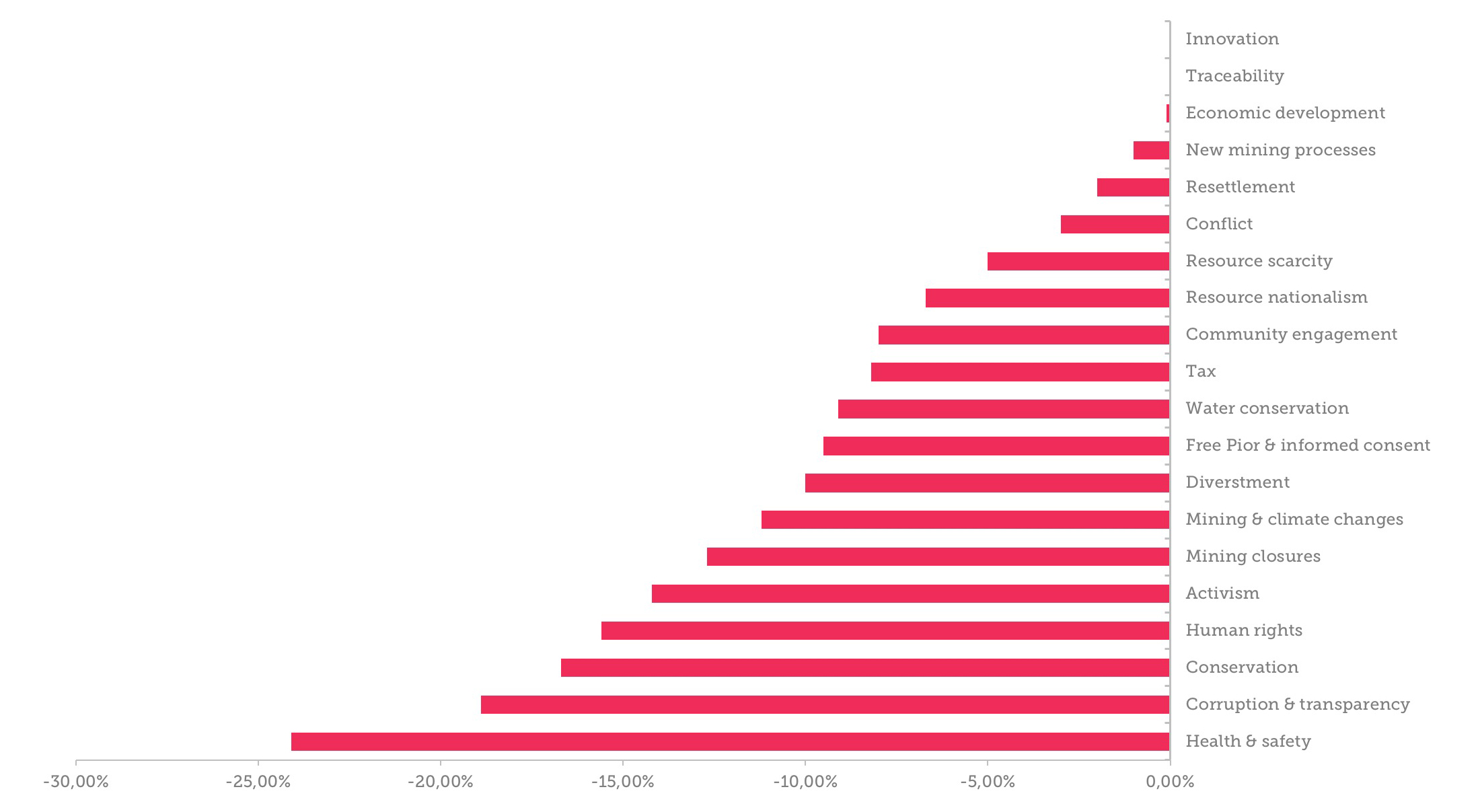

FIGURE 1: Reputation Risks for a FTSE100 mining company

This reputation risk profile already represents an enormous step forward for businesses in terms of getting a handle on the issues and events that threaten to undermine perception with key stakeholder groups.

But the data is not static and nor are the issues. Context, as ever in analytics, is king.

While it is helpful to quantify an individual organisation’s reputation risk profile, it may be that the issues that sit atop this list are simply the cost of doing business in a given sector. Oil and Gas firms are likely to be targeted on environmental grounds, while insurers will frequently face complaints over lack of payouts. Does this mean that these are the biggest reputational risks for all firms in these sectors? Not necessarily.

More often than not, it is the risks on which a company is negatively differentiated compared to its peers that are the most toxic. Trial transparency may be a relatively minor issue in the grand scheme of things for a pharma firm, but if your company is seen as significantly out of step on this issue relative to your peers, then there is the potential for activists or single-issue NGOs to target you on this matter.

Understanding not just your own reputation risk profile but also where you sit on each of your risks relative to the sector, is the key to spotting potential vulnerabilities which may initially be further down the list of immediate priorities.

With your reputational risk footprint measured and your relative risk exposure mapped, you have your baseline in place. What ‘normal’ looks like if you will.

Using these baseline values, companies can monitor any variance in their risk profile relative to these norms and be automatically alerted to this. A +/-5% shift in the expected sentiment levels on a particular topic would warrant further investigation and allows for earlier intervention and risk mitigation. Likewise, the real-time detection of a growing discussion of palm oil or Saudi Arabia or plastic waste, irrespective of whether it references a company, is an early-warning sign that these issues may gain greater stakeholder visibility and therefore pose greater reputation risk for companies exposed to them.

While reputation has long had its own reputation of being impossible to measure, nowadays with the right combination of data sources, machine learning techniques and a detailed understanding of how reputation functions, any company can both quantify and manage its reputation in real-time.

Be part of the Stakeholder Intelligence community