alva is now Penta. We are the world’s first comprehensive stakeholder solutions firm. Learn More

Hit enter to search or ESC to close

Sustainability and ethical investing is coming to the fore even in the most traditional money markets, as proactive investing towards sustainable goals is seen to generate solid returns.

Environmental, social and governance (ESG) criteria are being weighed to assess companies’ non-financial performance and investors are increasingly backing companies planning for a future where sustainability and ethical impact are central to survival.

Sorting through the mass of conflicting ratings, partial company self-disclosures and out-of-date filings makes it hard to understand the materiality of the ESG risks and opportunities a company faces, let alone how it compares to its market peers.

The challenge for investors and companies alike is how to accurately measure a business’ genuine ESG profile

Get in touch

To see how ESG Intelligence can help your business

The acceleration of investment in ESG portfolios has been matched only by the proliferation of third-party ESG content and the speed of its dissemination.

Encompassing elements as diverse as policy on palm oil to maternity leave allowance, diversity and inclusion policies, community outreach programmes, carbon footprint, and any number of sector-specific issues, the size of the field leaves companies open to backdoor risk.

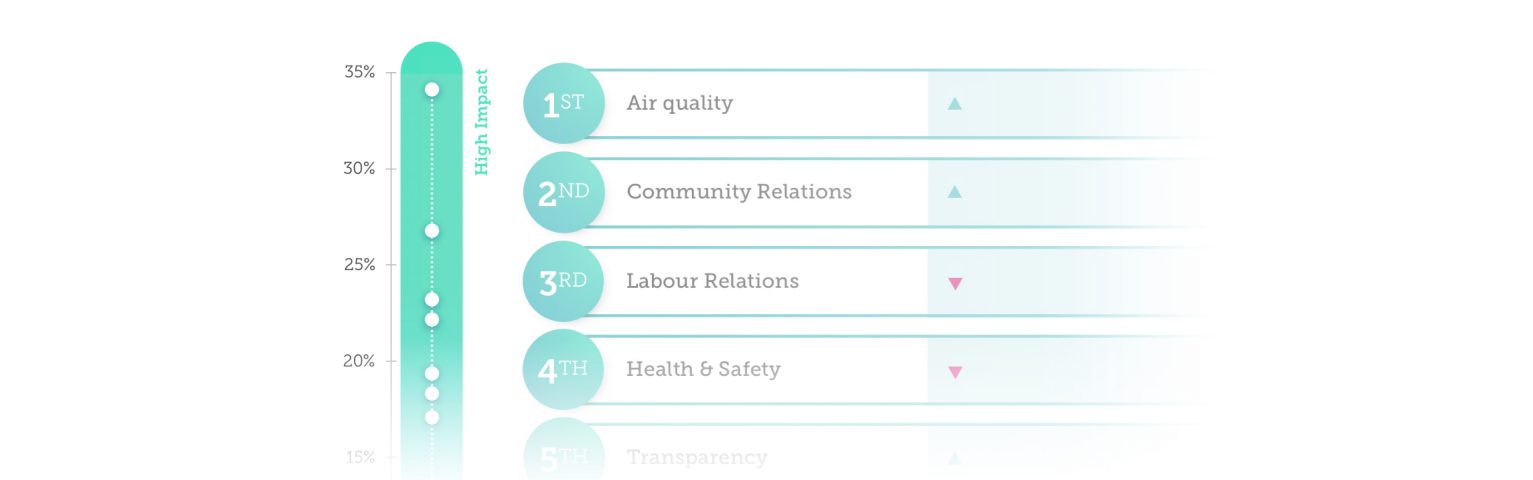

By proactively monitoring and measuring their ESG profile, companies are able to quickly identify issues which are gaining negative velocity, before they become material. Equally, by surfacing specific ESG issues in which the firm is seen to be a leader, these can be leveraged for greater competitive advantage.

Building on over 10 years of experience in delivering board-level reputation analysis to blue-chip firms, alva’s ESG Intelligence provides comprehensive analysis of how any company is performing against the SASB sector standard issues compared to their peer group.

Through the daily analysis of millions of pieces of publicly available content using the market-leading alva ESG score™, we provide real-time benchmarking of over 2,000 companies’ ESG scores, all indexed against the SASB standard taxonomy.

alva’s ESG Intelligence not only surfaces emerging ESG risks through its materiality assessment and benchmarking against peers, but further helps organisations understand how the company’s ESG profile can be a source of competitive advantage

alva parses over 25 million pieces of publicly available content from print, online, broadcast and social media sources, regulatory disclosures, NGO communications and many more, classifying them by the SASB sector standard issues taxonomy. Each piece of content is then analysed for sentence-level Sentiment based on a combination of Machine Learning and Natural Language Processing. The content is also given a Materiality score incorporating the volume of coverage, the influence of the source and the prominence of the issue.

The alva ESG™ score is calculated on a -100 to +100 range and combines Sentiment and Materiality in relation to ESG topics. Rankings are updated in real-time for 25 sectors. ESG Risks and Opportunities are identified at a company-level through historic sector-level normal score ranges being breached. These automatically trigger a notification to an alva ESG analyst to review, validate and alert the client.

alva’s ESG intelligence clients receive access to a one-year baseline ESG analysis report to configure the company and sector score norms, followed by regular monthly or quarterly ESG reports, presented by their ESG sector analyst.

Reports typically include the following analysis:

Media Intelligence

Communications

Reputation Intelligence

Corporate Affairs

Risk Intelligence

Risk

Board Intelligence

Board

Get in touch