Maximising the value of Fintech acquisition

In the last few years, there has been an increasing business and media focus on digital disruption. These have manifested in big developments in communication channels, e-commerce, hospitality and taxi services and there is speculation that the wider economy will follow.

In parallel, there has been a rising interest from companies in the financial sector to develop their digital offering through organic growth or partnering with technology firms. Additionally, UK and Ireland represented more than two-fifths of Fintech investments across Europe in 2014, with investment trebling from 2013 to 2014, as London has the ability to focus talent and finance.

For Professional Services firms, this has become a pressing subject.

PwC’s Head of Strategy, Richard Oldfield, describes the challenge faced by the sector from digital groups as “a tsunami of threats”. KPMG’s Technology Sector Head, Tudor Aw, meanwhile, comments that professional services firms need to alter their business models to “embrace the future”. This involves adopting a business model that demonstrates three core assets: data storage, data analytics and cloud technology (Harriet Agnew, FT.com).

With the Big 4 professional services firms all seeking to position themselves as leaders in the Fintech sector through acquisitions amid the digital disruption, alva used its comprehensive media monitoring and corporate analysis platform to investigate how successful these efforts have been. Our analysis seeks to answer the following key questions:

- Which firm is the most effective at communicating its Fintech acquisition activity?

- What are the focus areas of Fintech acquisition?

- Which communication channels should be used for best results?

Maximising the value of Fintech acquisition

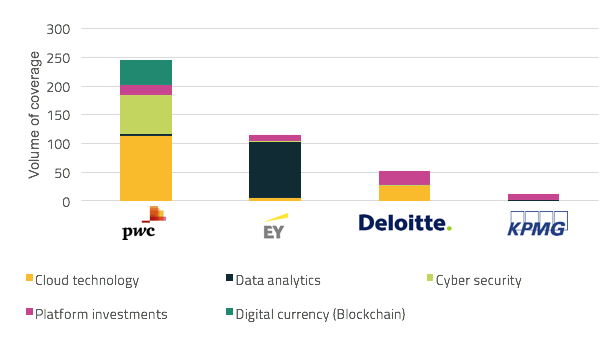

Fig 1: Score of FinTech acquisition within professional services

(Nov 15 – Feb 16, UK sources, English language)

.

All firms generated a positive score for Fintech. PwC achieved the highest sentiment score for its strategy, successfully generating positive reactions around its past (Strategy&) and present Fintech acquisition activity (Praxism and Outbox), as well as its future strategy (Blockchain technology). EY placed second with a large focus on current activity (LinkedIn partnership) and also concluded the four month period with a sentiment score above the sector average.

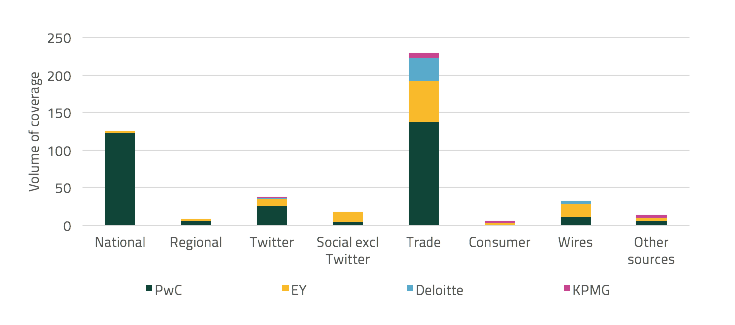

What are the focus areas of Fintech acquisition?

Over the four month period, the Big 4 firms demonstrated particular interest in specific Fintech areas as summarised in the chart below.

Fig 2: Big 4 by Fintech acquisition area

(Nov 15 – Feb 16, UK sources, English language)

.

PwC

The firm’s Fintech acquisition activity generated significantly more reaction in the media than its peers. It is clear that PwC is undertaking a wider range of digital investment. Some of the key successes for PwC included:

- Focus on PwC’s progress in cloud technology thanks to its acquisition of Outbox

- The acquisition of Praxism, Edinburgh-based identity and access management consultancy, highlighted PwC’s interest in boosting its cyber security offering

- PwC was the only company to feature an expansion strategy around digital currency with Blockchain technology.

EY:

- There was a large number of mentions of EY’s alliance with LinkedIn, which served to underline its data analytics and platform capabilities

Deloitte:

- Deloitte is viewed as active in cloud technology add-ons thanks to the acquisition of Cloud Computing Group.

- NorthPoint Digital was also helpful in boosting the firm’s visibility for its platform capabilities.

KPMG:

- KMPG’s acquisition of G2 FinTech, a boutique tax technology firm, and its incorporation of the flagship product TaxGopher within its KPMG LINK PartnerTrack platform, yielded limited visibility.

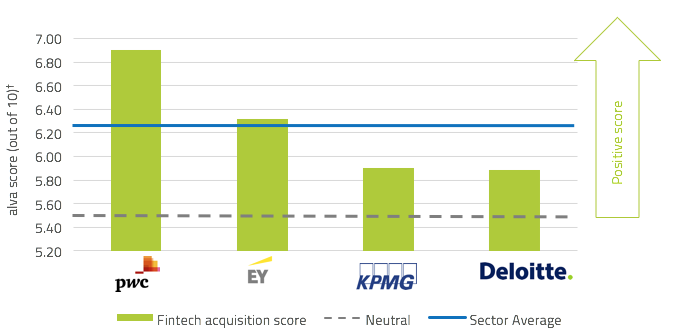

Does communication channel make a difference?

Fig 3: Big 4 Fintech acquisition coverage by source type

(Nov 15 – Feb 16, UK sources, English language)

.

As with any communication, the target audience and the desired outcome should inform where the company focuses its efforts. What is striking from the above graph is how successful PwC has been in seeding its Fintech expansion message across a wide range of sources. Both PwC and EY had a balanced distribution across all source types, unlike, for example, Deloitte, whose Fintech strategy generated reactions mainly from specialised trade sources, with lower impact.

Conclusion

From our media content analysis, we have identified three key findings:

- While all of the Big 4 professional services firms have generated positivity around their Fintech coverage, PwC is the standout performer.

- Being able to absorb or develop a range of specialised Fintech services creates a greater positive contribution than focusing on a single Fintech area. PwC generates more coverage by communicating its acquisitions and investments in a larger range of Fintech operations than its peers. Moreover,PwC is actively showing interest to invest in Blockchain developments which further differentiates itself among the Big 4 professional firms (Fig 2).

- Part of PwC’s success is down to its successful seeding of its message across multiple sources with different interest areas – that has not only made it more visible, but also broadened its audience (Fig 3)

Footnotes

† The alva algorithm calculates sentiment scores out of 10, where a score of 5.50 is considered neutral. A score above 6.00 is considered strong, while a score of 5.00 is considered weak.

Be part of the

Stakeholder Intelligence community